The “Purchase Price Allocation” requirement (PPA) – required in all contracts for sale and purchase, above $1,000,000, from 1 July 2021.

We cannot stress enough the IMPORTANCE of taking professional advice on this as soon as possible in the Sale and Purchase process. This is for both VENDORS and PURCHASERS. Getting this right OR wrong can be the difference in tens, or hundreds, of thousands of dollars.

Thinking of BUYING or SELLING, please get in contact now.

Just SOLD or PURCHASED, please get in contact now, advice is free.

Learn more – click the link:

PPA – Satge 1 – Sale and Purchase contract

Stage 1 will be raised by the Real Estate Agent and is to formalise between the Purchaser and Vendor, an agreement for the allocation of the purchase price to

- “depreciable” and

- “non-depreciable” items.

- TAKE ADVICE before agreeing to any figures here.

- YOU MUST INCLUDE A MINIMUM OF THREE CATEGORIES

- Land (non-depreciable)

- Buildings (non depreciable – from 1 April 2024)

- Fixtures and Fittings (Fit-out) (depreciable property) IMPORTANT – if this category is not included you will not be able to claim any depreciation!

PPA – Stage 2 – VALUIT Commercial Max

Stage 2 is to further split the value of “depreciable” items into all of the individual asset categories for depreciation to maximise your deprecaition. This is our COMMERCIAL MAX Service. This is completed at any stage before OR after settlement.

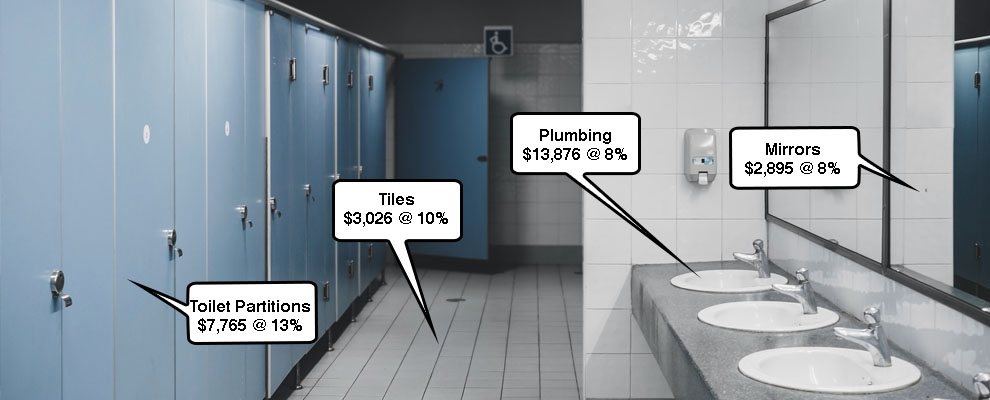

- Depreciable Property (Fixtures and Fittings – Fit-out)

- Air Conditioning

- Plumbing

- Electrical wiring ……..and much more

Unlock the Value of Your Commercial Property with a PPA. As a recent purchaser of commercial property, you’ve made a substantial investment. But are you fully aware of the tangible and intangible benefits that a STAGE 2 COMMERCIAL MAX Purchase Price Allocation (PPA) can bring to your investment?

Why a PPA is Essential for Commercial Property Owners. A Purchase Price Allocation (PPA) goes beyond being a mere requirement for commercial property owners; it serves as a financial strategy that can yield significant benefits. Firstly, a PPA enables the identification and separation of the value of depreciable and non-depreciable assets. Moreover, at PPA STAGE 2, the COMMERCIAL MAX ensures the segregation of depreciable assets, thereby maximizing depreciation and the resulting cashflow advantages.

Maximise Your Tax Benefits with a PPA. Secondly, a STAGE 2 COMMERCIAL MAX PPA can provide significant tax benefits. By accurately separating and identifying your assets, a COMMERCIAL MAX PPA allows you to depreciate assets over a shorter period, potentially leading to significant tax savings.

Learn more – click the link: