A game-changer for Commercial Property

Purchase Price Allocation: Why One Mistake Could Cost Thousands

Commercial property tax rules have shifted dramatically. From 1 July 2021, Purchase Price Allocation (PPA) became mandatory. Then, from 1 April 2024, depreciation on commercial buildings was removed again.

Together, these changes have reshaped how commercial property transactions are taxed. For both purchasers and vendors, the way a PPA is structured can mean the difference between:

Higher cash flow vs. lost deductions

A clean sale vs. unexpected tax recovery

A win-win outcome vs. avoidable disputes

At Valuit, we specialise in making sure your transaction is on the winning side.

What Is a Purchase Price Allocation (PPA)?

A PPA breaks down the total purchase price of a commercial property into its core components:

Land – never depreciable.

Building Structure – floors, roof, external walls (no longer depreciable).

Depreciable Assets – literally everything else!

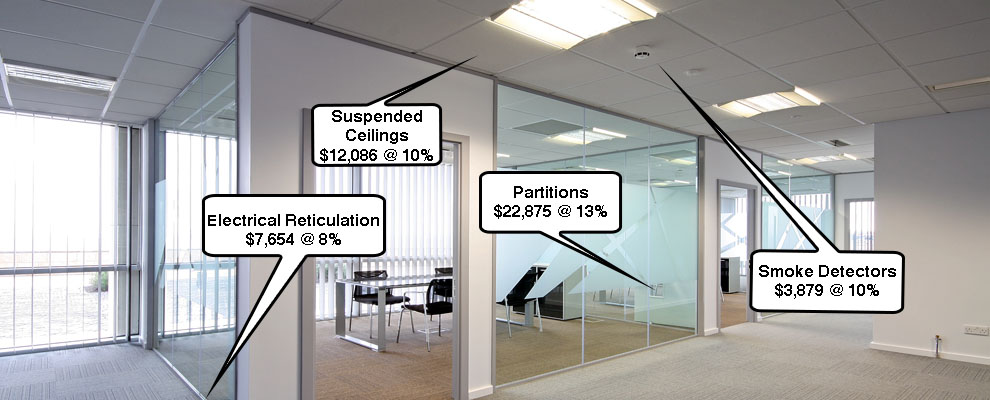

Examples of depreciable assets include:

Driveways, fencing, retaining walls, partitions, flooring, plumbing and electrical, HVAC, lifts, roller doors, lighting, signage, and much more.

If these items aren’t correctly separated in the PPA, the consequences are costly.

Risks for Purchasers.

Purchasers risk losing significant depreciation deductions if the PPA isn’t handled correctly:

No value allocated → No depreciation allowed, even if assets clearly exist.

Nominal values allocated → Restricted depreciation, limiting cash flow benefits.

In short:

No value = no depreciation. Nominal value = reduced depreciation.

Your return on investment can materially suffer if the PPA is wrong.

Risks for Vendors.

For vendors, the risk comes from depreciation recovery tax.

If a PPA is not properly structured, IRD can impose its own allocation, often resulting in a larger tax bill. Vendors who don’t take the lead risk:

Paying unnecessary tax on depreciation recovery.

Losing control if the IRD or purchaser sets the allocation.

Delays and disputes at settlement.

Preparation is key — vendors who plan ahead protect themselves and their deal.

The Opportunity: Creating a WIN-WIN.

A properly prepared PPA can create value for both parties:

Vendors avoid unnecessary depreciation recovery.

Purchasers maximise depreciation deductions.

Both parties achieve a faster, cleaner settlement.

Case Study:

Vendor proposed: Land $790,000 | Building $1,475,000 | Chattels $35,000

Valuit reassessed: Land $790,000 | Building Structure $1,279,000 | Depreciable Assets $231,000

Result:

Vendor: Tax neutral outcome

Purchaser: $20,000 extra depreciation in the first year

Why Most PPAs Still Get It Wrong.

Despite the rule changes, many Sale & Purchase Agreements still:

Allocate only to Land and Buildings, OR

Assign a token value to a few depreciable assets.

This creates inconsistency between vendor and purchaser, which is a breach of the PPA requirements. Once the agreement is signed, the opportunity is usually lost.

How Valuit Helps.

Valuit has developed a simple “Alternative Addendum” for PPAs that:

Separates land, buildings, and all depreciable assets

Meets IRD and contract law requirements

Provides transparency for both parties

Protects cash flow and reduces disputes

We’ve been specialising in depreciation and asset valuation for over 25 years, working with purchasers, vendors, accountants, and lawyers nationwide.

We:

Provide market-based valuations for PPAs

Help resolve legacy issues where depreciable assets weren’t separated

Keep professionals ahead of shifting tax rules

We cannot stress enough the IMPORTANCE of taking professional advice on this as soon as possible in the Sale and Purchase process. This is for both VENDORS and PURCHASERS. Getting this right OR wrong can be the difference in tens, or hundreds, of thousands of dollars.

Thinking of BUYING or SELLING, please get in contact now.

Just SOLD or PURCHASED, please get in contact now, advice is free.

What You Should Do.

Purchasers

Insist on a PPA that separates all depreciable assets

Check whether allocations are book value or market value

Ask for a list of assets the vendor depreciated

Get professional advice before signing

Vendors

Know your current tax position and book values

Confirm whether you’ve claimed all allowable depreciation

Pre-prepare a PPA with Valuit’s addendum before listing

Anticipate purchaser demands — and be ready with evidence

Final Thought.

This isn’t just a technical paperwork issue. It’s a real financial outcome.

Get it wrong → lost deductions, reduced cash flow, higher tax bills.

Get it right → tax-neutral outcomes, cleaner deals, stronger returns.

Talk to your accountant. Talk to your lawyer. Talk to Valuit.

We’ll help you turn complexity into clarity — and protect your position in every transaction.

IMPORTANT – This is just an overview and sometimes a little knowledge can be dangerous. We cannot stress enough the IMPORTANCE of taking professional advice on this as soon as possible in the Sale and Purchase process. This is for both VENDORS and PURCHASERS. Getting this right OR wrong can be the difference in tens, or hundreds, of thousands of dollars.

Thinking of BUYING or SELLING, please get in contact now.

Just SOLD or PURCHASED, please get in contact now, advice is free.