How it all works

The technical part explained – it’s all about cashflow

The technical part explained – it’s all about cashflow

The IRD allows you to run your investment property as a business. This means that you can claim the expenses incurred against the income received for it, in order to reduce tax liability.

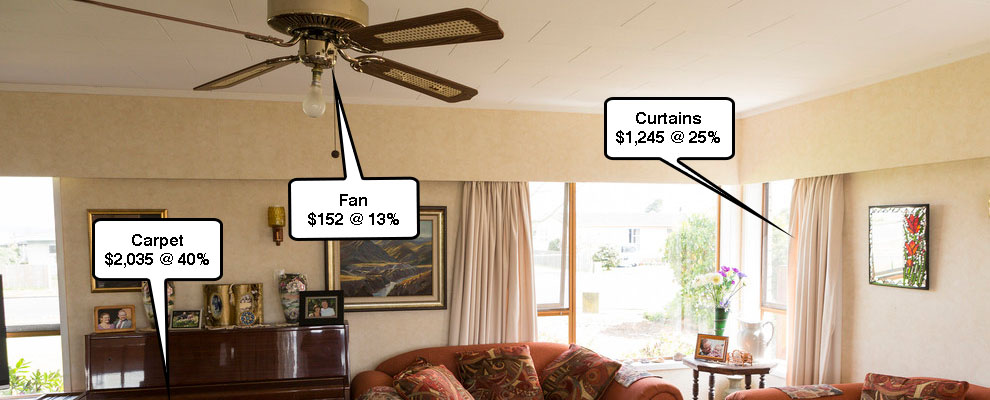

Depreciation is an expense that can be claimed to reduce taxable income.

Let’s have a look at an example of how depreciation can improve your cashflow:

Rental income of $400 /week $20,800

Less cash expenses (insurance, rates, etc) 5,000

Income before depreciation (cash in your pocket) 15,800

Less Non-cash expense (depreciation) 5,000

Taxable income after depreciation (what the IRD taxes you on) $10,800

Using this example, you can see that the end result will be that less tax is paid on the income received once depreciation is claimed.

Note that the actual amount of tax paid will depend on the type of ownership structure that is in place for the property, as well as other factors such as if the property has been purcahsed as a new build etc. Speak with your Lawyer and Accountant to make sure you have a structure in place that best suits your personal situation.

For years, residential property investors were able to use losses on rental properties to offset their personal tax.

Residential rental properties are often “negatively” geared. This means that the expenditure, including non-cash expenses such as interest and depreciation, exceeds the income, resulting in a loss.

The government introduced the ring-fencing of these losses, therefore preventing investors from using any losses against their personal tax.

The removal of the ability to claim the “Mortage Interest” as an expense will reduce the number of properties that are negativly geared.

At its most basic, for any property that does incur a loss, any losses are now carried over to the next income year. The losses won’t be able to be utilised until the investment makes a profit.

Its impact on Depreciation

If the property is negatively geared for tax it will simply mean that the cashflow benefit is deferred. So it is simply a timing change.

To see EXAMPLES or to use our CALCULATOR simply click here