A game-changer for Commercial Property

IMPORTANT – “SALE/PURCHASE PRICE ALLOCATION” AND “REMOVAL OF BUILDING DEPRECIATION”

Since 1st July 2021, the Purchase Price Allocation (PPA) has become a mandatory requirement for the majority of commercial property transactions. These regulations, enforced by the IRD, determine the value split of assets within commercial properties.

AND

From 1 April 2024, the commercial building depreciation has once again been reduced to 0%.

Many are overlooking the major impact the Purchase Price Allocation (PPA) rules will have when combined with the removal of Building Depreciation.

VALUIT have specialised in property depreciation and Purchase Price Allocations for 25 years. We have observed a concerning trend of shortcuts being taken by vendors/purchasers in relation to the PPA in agreements for sale and purchase due to a lack of knowledge. If this practice persists, it could greatly impact future transactions, adversely affecting both Vendors and Purchasers. It is crucial for Property Professionals and Investors to fully comprehend these implications and prevent potential issues. For future vendors, this oversight could lead to a substantial tax liability upon selling the property, and purchasers will have significantly reduced cash flow. While this issue may not be at the forefront of everyone’s mind currently, it will undoubtedly become a critical consideration when new purchasers miss out on $10’s – $100’000’s of tax relief.

“With over 25 years of experience in Property Depreciation, we have witnessed the most significant change in Commercial Property Depreciation to date.”

At VALUIT, it has become evident that there is considerable confusion in the market surrounding the recording of Purchase Price Allocation (PPA) in Sale and Purchase Agreements. It is crucial for all parties, to comprehend that the way this is structured can have serious tax implications for both the Vendor and Purchaser.

Understanding the PPA.

The Purchase Price Allocation (PPA) was introduced from 1 July 2021. This rule applies to all Commercial Property purchased for $1,000,000 or greater and Residential Property purchased for $7,500,000 or greater. The rule requires a separation in Asset Categories within the agreement for sale and purchase.

Its purpose is to ensure consistency in the tax treatment of depreciation between the seller and buyer. Both parties agree on the value of depreciable property through an allocation of the purchase price. Ideally, this allocation should encompass three categories (in the case of a standard property transaction):

- Land,

- Buildings, and

- Fit-out.

Understanding the removal of Building Depreciation.

The depreciation rate for Building Structures, with an IRD economic life of 50 years or more, was reduced to 0% from 1 April 2011 in accordance with the 2010 Budget. Prior to this the depreciation rate was 3% Diminishing Value

In March 2020, it was announced that, as part of the Business Continuity Package introduced to counter the economic impact of COVID-19, the depreciation of Building Structures for Commercial and Industrial property would be reinstated at 2% Diminishing Value, effective for the 2020/2021 financial year and onwards.

As of 1 April 2024 the Building Structure depreciation rate has once again been reduced to 0%.

Previously, we had the ability to further divide the Improvements value into the “Building structure” and “fit-out”, not the case for agreements signed after 1 April 2024 as these values are set within the PPA.

The good news is that for properties purchased from 1 April 2020 – 31 March 2024, there is the ability to separate out the value of fit-out if this was not done initially and to claim depreciation on this moving forward.

So, what is the problem?

We have had Building Depreciation removed previously, but the introduction of the PPA in 2021 is the game-changer.

Ideally, the PPA should encompass three categories:

- Land, Buildings, and Fit-out

However, in practice, many agreements only specify values for two categories:

- Land and Buildings.

The critical issue arises when the PPA only separates Land, and Buildings.

Now that Building Depreciation is eliminated, both “Land” and “Buildings” are asset categories with zero depreciation. By agreeing to these two values ONLY, buyers now effectively bind themselves to contracts that do not allow for any future depreciation.

Previously this was fine as you could separate out a value for fitout. However, for contracts signed after 1 April 2024, any attempt by the buyer to further divide the Building value creates a different tax position for the seller and buyer, this is what the IRD is combatting with the implementation of the PPA rules.

The impact.

While this issue may not be at the forefront of everyone’s mind currently, the cash flow impacts will undoubtedly become apparent as tax returns are filed.

- WHEN BUYING

The result is substantially reduced cash flow benefits. It is crucial for buyers to ensure that all PPA agreements assign separate values to Land, Buildings, AND Fit-out. The value attributed to fit-out is of utmost importance as it allows for depreciation and safeguards the buyer’s interests. Even if a value is attributed to Fit-out, it is wise to ensure this is reflective of Market value to ensure you gain the full cashflow advantage. We have seen plenty of agreed values on fit-out that are far below market value. This results in reduced cash flow benefits.

- WHEN SELLING

For vendors, the PPA oversight could lead to a substantial tax liability upon selling the property, or purchasers will have reduced cash flow, which could impact offers. As investors become more educated in this area, what is considered a minor oversight now may have considerable cash flow impacts when selling.

- EXISTING OWNERS

If you purchased the property between 1 April 2020 and 31 March 2024, and you have not separated the Fitout, you have a small window of opportunity to redress this. Great News!

In the detail – Case Study

AGREEMENT FOR SALE AND PURCHASE OF COMMERCIAL PROPERTY

IF NO VALUE IS PLACED ON FITOUT WITHIN THE PPA (Purchase Price Allocation) (Most common scenario VALUIT are seeing with the new PPA rules)

Purchase price $5,250,000

- Contract to purchase signed between 1 April 2020 – 31 March 2024

PPA AS AGREED IN SALE AND PURCHASE AGREEMENT (No separate value given to Fit-out)

Land $2,500,000 (Non-depreciable)

Buildings $2,750,000 (Non-depreciable after 1 Apr 24) TOTAL – DEPRECIATION $0

AS FURTHER ASSESSED BY VALUIT (Now available if not separated at purchase)

Land $2,500,000 (Non-depreciable)

Imp – Building Structure $1,950,000 (Non-depreciable after 1 Apr 24)

Fitout $800,000 (Depreciable) YEAR 1 – DEPRECIATION $85,000

- Contract to purchase signed after – 1 APRIL 2024

PPA AS AGREED IN SALE AND PURCHASE AGREEMENT (No separate value given to Fit-out)

DO NOT FALL INTO THIS TRAP

Land $2,500,000 (Non-depreciable)

Improvements $2,750,000 (Non-depreciable) TOTAL DEPRECIATION $0

NO FURTHER ASSESSMENT BY VALUIT AVAILABLE (No value agreed within the PPA for FIT-OUT)

Land $2,500,000 (Non-depreciable)

Buildings $2,750,000 (Non-depreciable) TOTAL DEPRECIATION $0

IMPORTANT NOTE: With NO VALUE being allocated to FITOUT (Depreciable Property) within the PPA, there is NO ABILITY TO CLAIM DEPRECIATION.

HOWEVER, IF ADVICE TAKEN FROM “VALUIT” AND AGREED IN SALE AND PURCHASE DOCUMENTATION

Land $2,500,000 (Non-depreciable)

Building Structure $1,950,000 (Non-depreciable)

Fitout and Equipment $800,000 (Depreciable) YEAR 1 – DEPRECIATION $85,000*

* Based on “VALUIT” apportioning the value of FIT-OUT across the various IRD depreciation categories.

The next step – getting it right for the future.

Addressing this challenge is not complex – it requires education.

Understanding these changes is crucial for navigating commercial property transactions effectively in the new regulatory environment.

Here is what you need to be considering post-1 April 2024.

EXISTING OWNERS

If you purchased between 1 April 2020 and 31 March 2024 you have been given a reprieve.

- Take a look at your Sale and purchase agreement; if you did not separate out a value for FIT-OUT from the Building Value when you purchased the property, you can do this NOW!

- Increased cash flow is awaiting; what are you waiting for?

WHEN BUYING

- READ AND UNDERSTAND your obligations as per the Sales and Purchase Agreement!

- Take early advice from an expert, such as “VALUIT”, even before you make your offer.

- The PPA must include separate values on “LAND”, “BUILDINGS”, and “FIT-OUT”

- Ensure the FITOUT value is representative of Market Value. This is critical to maximising cash flow.

- DO NOT agree to an itemised list of Fit-out items and corresponding values, this is not required and could be detrimental. It just needs to be the Total Value.

- Agree on the PPA before

- Understand the impact of NOT getting this right.

WHEN SELLING

- READ AND UNDERSTAND your obligations as per the Sales and Purchase Agreement!

- Talk with your Accountant to ensure you know what the current book values are.

- Ensure the value on FITOUT includes all depreciable items.

- Understand the “Written down book value” does not necessarily equal “Market Value”.

- Understand that in the scheme of things, if you do have to pay some Depreciation Recovery, it is likely to be minimal.

The “Purchase Price Allocation” requirement (PPA) – required in all contracts for sale and purchase, above $1,000,000, from 1 July 2021.

We cannot stress enough the IMPORTANCE of taking professional advice on this as soon as possible in the Sale and Purchase process. This is for both VENDORS and PURCHASERS. Getting this right OR wrong can be the difference in tens, or hundreds, of thousands of dollars.

Thinking of BUYING or SELLING, please get in contact now.

Just SOLD or PURCHASED, please get in contact now, advice is free.

PPA – Satge 1 – Sale and Purchase contract

Stage 1 will be raised by the Real Estate Agent and is to formalise between the Purchaser and Vendor, an agreement for the allocation of the purchase price to

- “depreciable” and

- “non-depreciable” items.

- TAKE ADVICE before agreeing to any figures here.

- YOU MUST INCLUDE A MINIMUM OF THREE CATEGORIES

- Land (non-depreciable)

- Buildings (non depreciable – from 1 April 2024)

- Fixtures and Fittings (Fit-out) (depreciable property) IMPORTANT – if this category is not included you will not be able to claim any depreciation!

PPA – Stage 2 – VALUIT Commercial Max

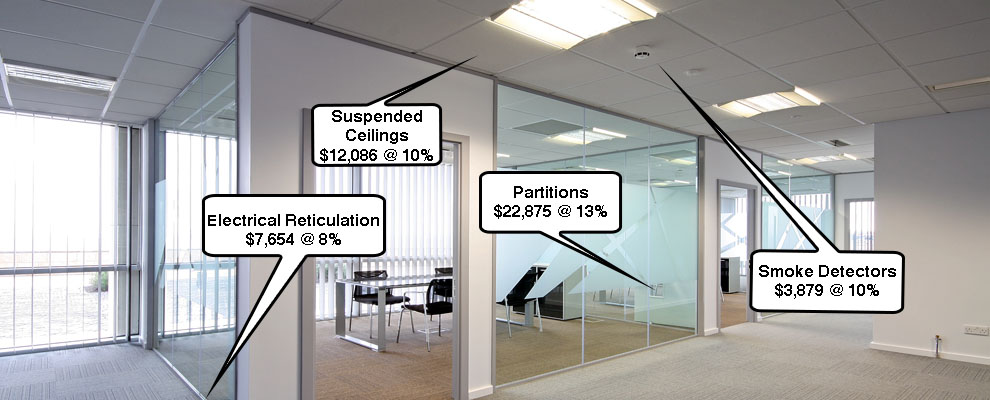

Stage 2 is to further split the value of “depreciable” items into all of the individual asset categories for depreciation to maximise your deprecaition. This is our COMMERCIAL MAX Service. This is completed at any stage before OR after settlement.

- Depreciable Property (Fixtures and Fittings – Fit-out)

- Air Conditioning

- Plumbing

- Electrical wiring ……..and much more

- Depreciable Property (Fixtures and Fittings – Fit-out)

Unlock the Value of Your Commercial Property with a PPA. As a recent purchaser of commercial property, you’ve made a substantial investment. But are you fully aware of the tangible and intangible benefits that a STAGE 2 COMMERCIAL MAX Purchase Price Allocation (PPA) can bring to your investment?

Why a PPA is Essential for Commercial Property Owners. A Purchase Price Allocation (PPA) goes beyond being a mere requirement for commercial property owners; it serves as a financial strategy that can yield significant benefits. Firstly, a PPA enables the identification and separation of the value of depreciable and non-depreciable assets. Moreover, at PPA STAGE 2, the COMMERCIAL MAX ensures the segregation of depreciable assets, thereby maximizing depreciation and the resulting cashflow advantages.

Maximise Your Tax Benefits with a PPA. Secondly, a STAGE 2 COMMERCIAL MAX PPA can provide significant tax benefits. By accurately separating and identifying your assets, a COMMERCIAL MAX PPA allows you to depreciate assets over a shorter period, potentially leading to significant tax savings.

STAGE 1 PPA – Key points.

- A Purchase Price Allocation (PPA) requirement was introduced on 1 July 2021 which is causing confusion in the market.

- It is important that RE Agents are aware of the potential ‘depreciation recovery’ implications to both parties which should be taken into consideration when drawing up a contract.

- There are differing views between the IRD and REINZ on how the PPA rules are managed, and it is best practise for all parties to agree allocation in the sale and purchase agreement before settlement.

- If no agreement is reached, then different scenarios may arise depending on who makes the determination – e.g who can benefit from claiming depreciation or experience losses due to limitations to claim depreciation.

- The PPA MUST INCLUDE a value for FIXTURES AND FITTINGS (FIT-OUT)

STAGE 1 PPA – Sale and Purchase Agreement – Timing is everything.

VENDOR

- Agree with purchaser BEFORE settlement OR

- Vendor may allocate values in the 3 months following settlement OR

- Purchaser may allocate values in the 4-6 months following settlement (NOT IDEAL) OR

- IRD will decide (NOT IDEAL)

PURCHASER

- Agree with Vendor BEFORE settlement OR

- Vendor may allocate values in the 3 months following settlement (NOT IDEAL) OR

- Purchaser may allocate values in the 4-6 months following settlement OR

- IRD will decide (NOT IDEAL)

Most imprtantly – once the PPA has been agreed (Stage 1) there is the opportunity to further split the items within the FIXTURES AND FITTINGS CATEGORY to ensure depreciation is maximised (Stage 2).

STAGE 2 PPA – VALUIT Commercial Max

PURCHASER – Once property has settled.

- Contact the team at Valuit to discuss the opportunity of maximising your depreciation.

QUESTION – If I need to complete an assessment in accordance with the Purchase Price Allocation (PPA) rules, then my accountant will surely advise me. Is this correct?

ANSWER – It is important to note that relying solely on your accountant’s advice may not be sufficient. Accountancy is a vast field, and not all accountants may be fully up-to-speed on PPA rules. The benefits of complying with PPA rules are substantial, and therefore we recommend that the purchaser takes the initiative to understand and comply with these rules rather than waiting for direction from their accountant. Our team at Valuit Asset Appraisals Limited can provide expert guidance and support in this area to ensure compliance with PPA rules, enabling you to maximize the benefits of your investment in commercial property.

QUESTION – Is it worthwhile completing a PPA Stage 2 – Commercial Max, if I will only have to pay it back through Depreciation recovery?

ANSWER – Absolutely, completing a Stage 2 PPA assessment is highly recommended for purchasers of commercial property. In fact, since 1 July 2021, the majority of sales are required to include PPA assessments. While it’s true that you may need to pay back some depreciation in the form of depreciation recovery when you sell the property, completing a Stage 2 PPA assessment can actually help to minimize this. By having clear book values for your assets, you will have a solid basis to form an agreement on values with a purchaser when the time comes to sell. This can help expedite the process and ensure a smoother transaction overall.

At Valuit Asset Appraisals Limited, we specialise in providing comprehensive assessments and valuations to ensure compliance with IRD regulations and maximize the benefits of your investment in commercial property. Our team of experts is here to assist you every step of the way and provide you with clear, concise, and authoritative information. We encourage you to take action and get started on your PPA assessment today to benefit from having more information at your disposal when you decide to sell.

QUESTION – Why is an additional split of the purchase price necessary when the government may remove building depreciation? “THIS IS NOW HAPPENING AS AT 1 APRIL 2024”

ANSWER – This is why a full Purchase Price Allocation (PPA) is essential. A PPA will split out items from the building structure, fixtures and fittings, such as plumbing, flooring, electrical, partitioning, etc. These items all depreciate at differing rates. Without a PPA, if the government removes building depreciation, you will not get any depreciation benefits. Therefore, it is important to have a PPA assessment to ensure that you are aware of the book value of assets in your commercial property investment. Valuit Asset Appraisals Limited specializes in providing comprehensive assessments and valuations to ensure compliance with regulations and maximize the benefits of your investment. Get in touch with us today to learn more.

QUESTION – Why do I need Valuit Asset Appraisals Limited if there is already a Purchase Price Allocation in the agreement that has been signed?

ANSWER – Even if there is already a Purchase Price Allocation (PPA) in the agreement, it can be beneficial to have an expert review of what has been agreed upon. At Valuit Asset Appraisals Limited, we can provide recommendations on how to maximize your return. Most PPAs will have very little detail, and it is the detail that we can add in the form of further splitting the values into items of depreciable property where the real value is achieved.

It is important to note that while the building structure itself depreciates at a very low rate of 2% diminishing value per annum (0% from 1 April 2024), other items such as carpets, flooring, electrical, plumbing, etc., all depreciate at much higher rates and provide significant cashflow benefits. By conducting a comprehensive assessment and valuation, we can help you understand the true value of your assets and identify areas where you may be able to increase your returns. Get in touch with us at Valuit Asset Appraisals Limited to learn more about how we can help you maximize your return on investment.

Trust Valuit Asset Appraisals Limited for Your PPA. At Valuit Asset Appraisals Limited, we are experts at conducting PPAs. Our team of professionals will ensure that you not only meet your PPA requirements but maximise the financial benefits as well.

Invest Wisely, Reap the Rewards. A PPA is a powerful tool in a commercial property owner’s arsenal. It’s not just about meeting a requirement, but about unlocking the hidden value within your investment. So, take the step today to fully understand and utilise your commercial property’s potential with Valuit Asset Appraisals Limited.

IMPORTANT – This is just an overview and sometimes a little knowledge can be dangerous. We cannot stress enough the IMPORTANCE of taking professional advice on this as soon as possible in the Sale and Purchase process. This is for both VENDORS and PURCHASERS. Getting this right OR wrong can be the difference in tens, or hundreds, of thousands of dollars.

Thinking of BUYING or SELLING, please get in contact now.

Just SOLD or PURCHASED, please get in contact now, advice is free.